Zero Deductible Health Insurance: Peace of Mind or Too Expensive?

Introduction to Zero Deductible Health Insurance:

Healthcare costs keep going up every year, and because of this, many people want insurance that can protect them from big medical bills. One popular choice now is zero deductible health insurance. With this plan, people get coverage immediately without paying a lot upfront. But is this plan as great as it sounds, or can it secretly cost too much?

This big guide will help you understand zero deductible health plans, how they work, and whether they match you and your budget. We will also talk about the good and bad sides, share some real-life examples, and show you other options so you can choose the best plan for you and your family.

What Is Zero Deductible Health Insurance?

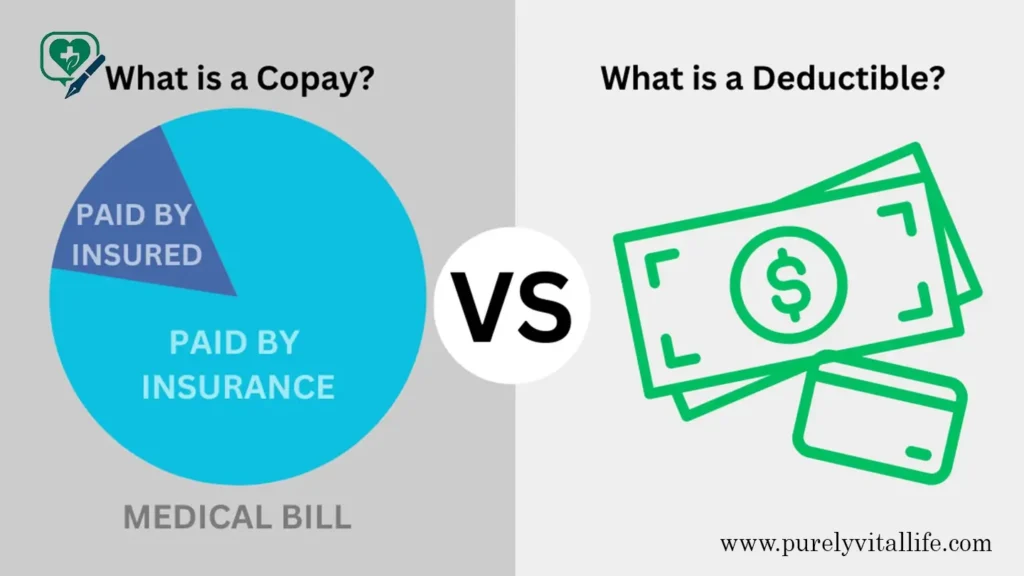

Zero deductible health insurance (sometimes called no deductible insurance) is a plan where you do not need to pay any money before your insurance starts helping you. In most regular plans, you must pay a certain amount first (a deductible), and the insurance pays only after that. For example, if your deductible is $2,000, you pay all medical bills up to $2,000 before insurance helps.

However, with a zero deductible plan, your insurance pays right away after you start paying your monthly fee (called a premium). You do not have to reach any amount first.

Big insurance companies like Blue Cross Blue Shield, Aetna, and Cigna offer these plans, but they are unavailable everywhere. More and more people choose these plans because they like having fixed costs and getting medical help immediately.

Read More About Is Acupuncture Insurance Coverage? A Complete Guide to Benefits & Options — >>>

How Do Zero Deductible Health Insurance Plans Work?

Zero-deductibleZero-deductible plans work. Your insurance starts paying for your care right away. However, you will still have to pay smaller costs, such as copayments and coinsurance.

Here’s how the costs usually work:

- Monthly Premiums: You will pay more monthly than monthly plans with high deductibles. The higher monthly cost helps the insurance company cover the immediate care you get.

- Copayments: You usually pay a small fee when you visit a doctor (around $20-50), go to a specialist (around $40-80), or get medicine (about $10-30 for generic drugs).

- Coinsurance: For big things like staying in the hospital or having surgery, you might pay part of the cost (usually 10-20%) after your copay, but this starts immediately instead of waiting to reach a deductible.

- Coverage Inclusions: Many zero deductible plans cover preventive care like yearly check-ups, vaccines, and mammograms completely, so you do not pay anything extra. Medicine costs are split into different levels with different copays.

What Should You Know About Your Coverage?

- It’s important to know that not all services cost the same. For example, going to the emergency room might have a higher copay ($200-500), but urgent care usually costs less ($75-150).

- Some plans might also have separate deductibles for certain medicines or mental health care, so it’s very important to read your plan carefully.

- Also, if you go to a doctor or hospital that is not part of your insurance’s network (called out-of-network), you might have to pay a lot more or even the full cost.

The Pros of Zero Deductible Health Insurance:

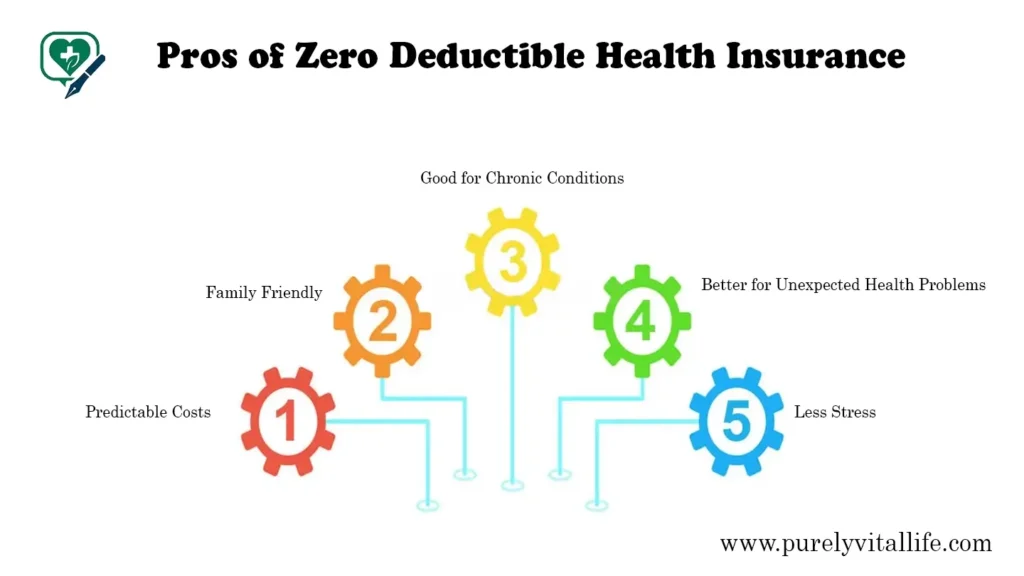

Zero deductible plans have many benefits, making them a good choice for some people and families.

- Predictable Costs: With fixed costs, plan to track how much of your deductible you’ve paid. You know upfront how much you will pay for most services.

- Good for Chronic Conditions: If you have diabetes, heart problems, or other long-term health issues, this plan can help you save money and feel more secure.

- Family Friendly: Families with kids often need many doctor visits, vaccines, and urgent care. This plan helps make those costs more predictable and affordable.

- Less Stress: You don’t have to worry about huge bills if there is an emergency. You can focus on getting better instead of worrying about money.

The Cons of Zero Deductible Health Insurance:

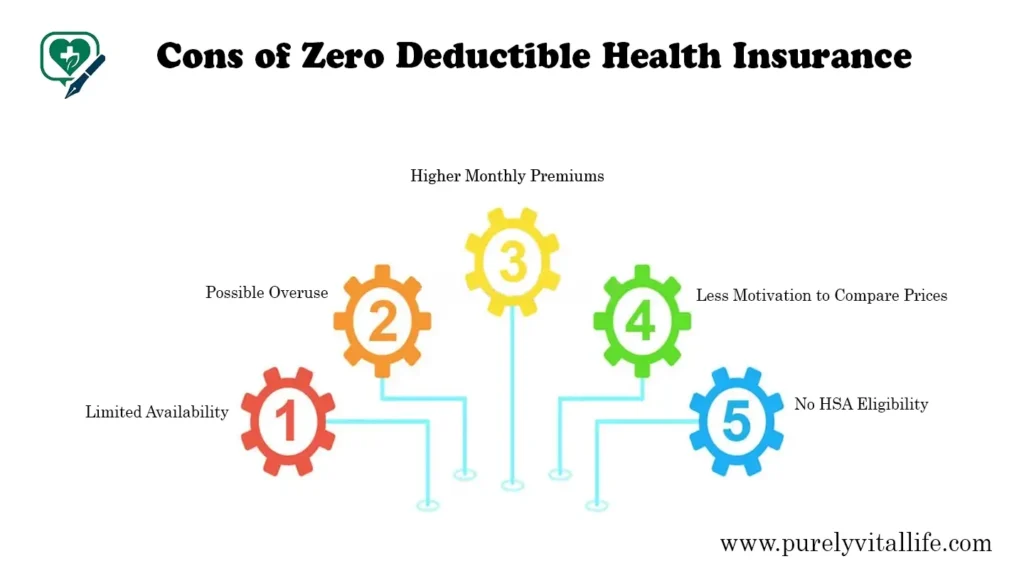

Even though there are many good sides, these plans also have some downsides.

- Higher Monthly Premiums: You have to pay more money every month. These plans can be 20-40% more expensive than plans with high deductibles, which can be hard for families with tight budgets.

- Limited Availability: Not every company or state offers these plans, so you might have fewer choices.

- Possible Overuse: Because it is so easy to see a doctor, some people might go even when it is not needed, raising overall healthcare costs.

- Less Motivation to Compare Prices: Since your insurance pays most costs, you might not look for cheaper doctors or services.

- No HSA Eligibility: With these plans, you can’t use a Health Savings Account (HSA). HSAs let you save money tax-free for health expenses and can be a great way to save in the long term.

Who Should Think Twice About Zero Deductible Plans?

People who are usually healthy and do not go to the doctor often might not need a zero-deductible plan. Young adults without chronic illnesses can save money with a high-deductible plan, especially if they use an HSA for extra savings.

Who Should Think About Choosing Zero Deductible Plans?

Some people benefit from these plans.

- People with Chronic Health Problems: If you need to see doctors often or take regular medicine, the predictable costs can help you.

- Families with Young Kids: Kids need many check-ups, vaccines, and sometimes urgent care. These plans help parents manage expenses better.

- Older Adults Before Medicare: People close to retirement but not yet on Medicare often have more health needs, and this plan can help cover those costs.

- People Who Use Health Care a Lot: If you visit doctors many times a year, need surgeries, or take many medicines, these plans can be worth the higher monthly payments.

- People Who Want Predictable Bills: Some feel safer knowing their monthly monthly costs, even if they might pay a bit more overall.

Also Read About How to Choose the Best Travel Insurance Plans for Your Next Trip — >>>

Self-Check Questions:

To decide if this plan is good for you, think about these questions:

- Do you visit doctors more than four times a year?

- Do you take medicine regularly?

- Does someone in your family have ongoing health problems?

- Would a big medical bill cause financial trouble for you?

- Do you like having the same bills each month instead of different amounts?

- Have you ever skipped seeing a doctor because it was too expensive?

A zero-deductible plan might be a good option if you answered “yes” to a few.

Other Choices Instead of Zero Deductible Plans:

If zero deductible health insurance doesn’t feel right for you, don’t worry! You have other options.

- Low-Deductible Plans: These have smaller deductibles (usually $500-1,500). You pay less per month than zero deductible plans and still have lower costs before your insurance starts paying.

- High-Deductible Plans with HSAs: These plans have higher deductibles ($1,400+ for a single person, $2,800+ for a family), but you can use an HSA. HSAs let you save money tax-free and use it for health costs later.

- Employer-Sponsored Plans: Many jobs offer plans with low or no deductibles. Companies often help pay for these, making them cheaper than private plans.

- Health Sharing Plans: These are not real insurance. Instead, people share each other’s medical costs. They usually cost less per month but don’t cover as much or have strong protections.

- Short-Term Medical Insurance: These plans help if you need coverage for a short time. They cost less but often don’t cover existing health problems or follow all insurance rules.

The best choice depends on your health, money situation, and risk tolerance. Young, healthy people usually do better with high-deductible plans and HSAs, while people with more health needs may prefer low-deductible plans.

Real-Life Examples:

Seeing examples can help you understand better.

Example 1: The Johnson Family’s Story

Sarah and Mike Johnson have two children, ages 3 and 6. Their zero-deductible family plan costs them $800 each month, but it covers many doctor visits.

Last year, they had:

- 12 doctor visits for the kids ($25 each = $300)

- One emergency room visit for a broken arm ($150)

- Several medicines ($15-30 each = $200)

- Vaccines ($0 because preventive care is fully covered)

Their total out-of-pocket cost was $650, plus $9,600 in premiums.

If they had chosen a high-deductible plan that cost $500 per month and had a $3,000 deductible, they would have paid $6,000 in premiums and $3,000 before insurance helped, totalling $9,000.

Example 2: James and His Diabetes

James, who is 45 and has Type 2 diabetes, chose a zero deductible plan after paying a lot with his old plan.

Every year, he has:

- Four specialist visits ($40 each = $160)

- Monthly medicines ($25 for insulin and $15 for another = $480)

- Four lab tests ($30 each = $120)

- Eye and foot exams ($40 each = $80)

His total out-of-pocket cost is $840, plus his premiums. James likes knowing his exact costs to plan and avoid missing important care.

Also Read About Ultimate Guide to Choosing the Best Travel Insurance for your Trip — >>>

Conclusion:

Ultimately, zero deductible health insurance can make people feel safe because they know what they will pay and can get care immediately. However, it costs more each month and might not be the best choice for everyone. People with many doctor visits or families with young kids might love this plan, while healthy people might save money with other plans. By asking yourself the right questions and learning about all the options, you can pick the health plan that makes you feel safe and fits your budget. Remember, choosing the right strategy is a big decision, so take your time and think carefully!