Introduction to Acupuncture Insurance Coverage:

Acupuncture is becoming very popular as a safe and trusted way to manage long-term pain, reduce stress, and feel better overall. Many people now see this traditional Chinese medicine as a natural way to heal. As more people learn about the amazing benefits of acupuncture, one big question comes up: will your insurance help pay for it? At first, understanding acupuncture insurance coverage can feel confusing and stressful. But don’t worry — it does not have to be hard. In fact, many insurance companies now see how helpful acupuncture can be for certain health problems. Because of this, they are starting to include it in their plans.

This easy-to-follow guide will clearly explain the main things that affect acupuncture insurance coverage. It will also give you simple steps to check your benefits so you can see if your plan will help pay. And if your plan doesn’t include acupuncture, don’t worry! We will also share smart and practical ideas you can try instead.

By the end of this guide, you will feel confident and ready. You will have all the knowledge and tools you need to make smart choices. So, you can decide if you want to include acupuncture in your wellness journey and improve your health in a cost-friendly way.

What is Acupuncture Insurance Coverage and Why is It Becoming Popular?

Acupuncture is a very old healing practice from Chinese medicine. In this treatment, experts carefully put thin, clean needles into certain points on your body to help you heal naturally. Because of this, acupuncture can improve blood flow, release feel-good chemicals called endorphins, and balance your body’s energy paths, which people call meridians.

Also Read About Who Are Payers in Healthcare? — >>>

Cite Medical Studies:

Today, more and more doctors and hospitals accept acupuncture because strong scientific studies show it really works. In fact, research in medical journals shows that acupuncture helps with many problems like long-lasting back pain, migraines, arthritis, and even anxiety. Even more, clinical studies show that acupuncture can lower pain levels by 30–50% for many people. So, it has become a great extra treatment that works well with regular medical care.

Integration Acupuncture Insurance Coverage Into Mainstream Healthcare System:

Because of these results, healthcare systems across the United States are now adding acupuncture to their treatment plans. Many big hospitals and medical centers now offer acupuncture along with regular therapies. This is because they know it helps take better care of patients in a complete way. As a result, insurance companies have started to think again about covering acupuncture in their plans.

In particular, acupuncture’s success with back pain has caught a lot of attention. Many doctors and insurance companies now see how helpful it can be. In fact, many studies show that acupuncture gives long-lasting relief to people with chronic back pain. It also helps them depend less on pain medicines and, even better, improves their daily lives.

Understanding Acupuncture Insurance Coverage:

What You Need to Know About Insurance and Alternative Therapies:

Alternative medicine coverage has a special place in the world of insurance. Unlike regular medical treatments that follow clear rules, complementary therapies like acupuncture often need extra checks from insurance companies. They want to see if the treatment is really needed and if it saves money in the long run.

How Coverage Decisions are Made:

Insurance companies make coverage choices based on several important factors. First, they look at strong scientific proof that shows the treatment works well. Then, they think about what health problem the person has. After that, they see if acupuncture is a cheaper and better choice compared to regular treatments. Because of this careful review, some health conditions get covered, but others do not.

The good news is that, over the past ten years, more insurance plans have started covering acupuncture. In fact, many insurance companies now include acupuncture in wellness benefits or preventive care services. They know it can help fix health problems early and stop them from turning into bigger, more expensive issues later. As a result, they see acupuncture as a smart way to save money and keep people healthy for a longer time.

Read More About Medical Insurance for Unemployed: A Complete Guide for 2025 — >>>

Insurers Now Include Acupuncture:

Does Medicare cover acupuncture? Yes! In 2020, Medicare started covering acupuncture for people with chronic low back pain. This was a big step forward and showed that more people now accept acupuncture as real medical care. Because of this, many private insurance companies have also started to rethink their own coverage rules. This change has created a ripple effect that has spread across the entire insurance industry.

The way insurance companies see acupuncture depends on each plan. Some companies call it a medical treatment, while others think of it as a wellness service. For example, some plans cover acupuncture only when a doctor says it is needed for certain health problems. But other plans include it as part of bigger wellness programs to keep people healthy. So, it is very important to understand how your insurance plan handles acupuncture. This helps you know what to expect and stops you from being surprised later.

Factors Influencing Acupuncture Coverage:

Type of Insurance Plan:

Your type of insurance plan also makes a big difference in whether you can get acupuncture covered. Health Maintenance Organizations (HMOs), for example, usually need you to get a referral from your main doctor first. They also make you see doctors who are in their network. This system can make it harder to get acupuncture at first. However, once you get approval, it often gives you better and more complete coverage for your treatment.

Preferred Provider Organizations (PPPOs):

Preferred Provider Organizations (PPOs) give you more freedom when picking acupuncture doctors. In fact, they even let you see doctors who are not in their network. While you will pay more money for these out-of-network services, PPOs usually give better and more complete coverage for alternative treatments like acupuncture.

Point of Service (POS) plans mix features from both HMOs and PPOs. With POS plans, you still need a referral from your main doctor to get coverage. However, you can also go to doctors outside the network, but you will pay more. Even so, these plans can offer good acupuncture coverage if you have the right medical papers and referrals.

Also Read About How to Choose the Best Travel Insurance Plans for Your Next Trip — >>>

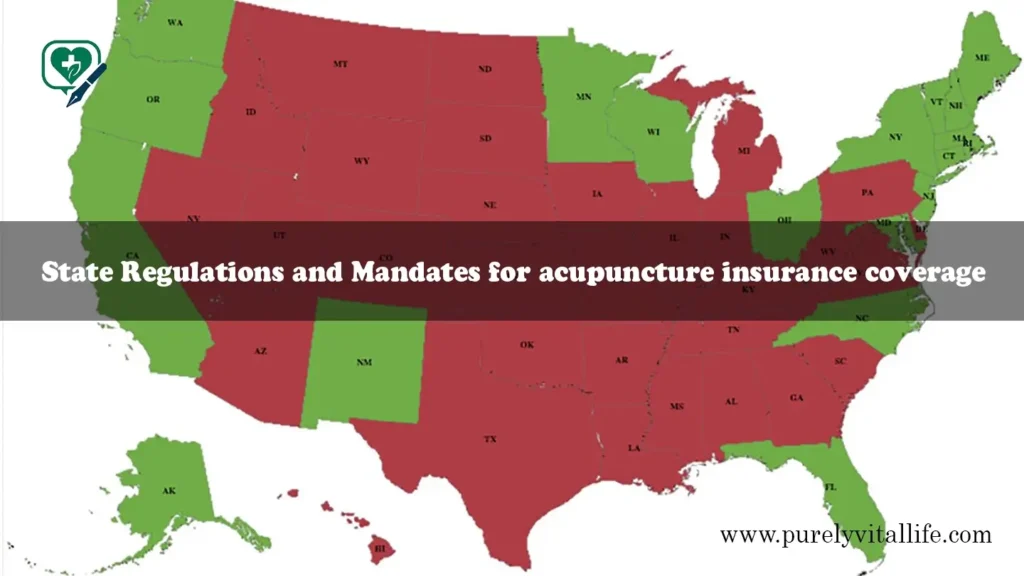

State Regulations and Mandates:

State laws also play a huge role in deciding if insurance covers acupuncture. In fact, some states have passed special laws that make insurance companies cover acupuncture in certain situations.

For example, California is a leader in this area. It has strong rules that make most insurance plans cover licensed acupuncturists. Other states like New York, Nevada, and Rhode Island have similar rules, but the details can be different in each state.

Usually, these state laws focus on health problems where acupuncture has been proven to work well. Chronic pain issues, like back pain and arthritis, get the most reliable coverage under these state rules. As a result, people in these states can get better help when they need acupuncture for pain relief.

Medical Condition Being Treated:

The health problem that makes you need acupuncture plays a big role in whether insurance will cover it. In fact, insurance companies are more likely to say yes when strong research shows that acupuncture really works for that condition.

Chronic back pain is the most common problem that insurance covers for acupuncture. This is because a lot of research shows that acupuncture helps with back pain. Many studies show that acupuncture can lower pain by 40% or even more when compared to regular care alone.

Besides back pain, problems like migraine headaches, osteoarthritis, and nausea after surgery also get good coverage from many insurance companies. These problems have strong research support and clear treatment steps that make it easier for insurance companies to understand and approve.

Mental health issues like anxiety and depression are also getting more attention for acupuncture treatment. However, coverage for these problems is very different from one insurance company to another. Some insurance plans put acupuncture under mental health benefits. But others call it alternative medicine and use different rules to decide if they will pay for it.

Step-by-Step Guide to Verifying Your Acupuncture Benefits:

Contacting Your Insurance Provider:

To start, call the customer service number on your insurance card to ask about acupuncture coverage. It is important to get ready with clear questions so you can learn as much as possible and feel confident.

Ask these important questions: “Is acupuncture covered under my current plan?” “What health problems can get acupuncture coverage?” “Do I need a referral from my main doctor?” “How many sessions can I have each year?” “What will I pay for copay and deductible?”

Also, ask for a list of acupuncture doctors near you who are in-network. Even though insurance companies often have online directories, calling them helps you get the newest and most accurate list. It also helps you check if a certain doctor is really in their network right now.

Reviewing Your Policy Documents:

Your insurance policy papers have detailed information about acupuncture coverage. However, the words can sometimes be hard to understand. So, look for sections called “Alternative Medicine,” “Complementary Therapies,” or “Chiropractic and Acupuncture Services.” These sections will help you find the right details quickly.

Next, pay close attention to the limits of your coverage. For example, some plans only let you visit 12 times a year. Others put a dollar limit, like $500 each year, on how much they will pay. Because of this, you need to know these limits before you start treatment.

Then, write down any special rules you find, such as if you need permission before starting (called pre-authorization) or if you need a note from your doctor. Knowing these things ahead of time will help you avoid problems and make sure you get coverage when you need it.

Understanding Policy Exclusions and Limitations:

Insurance plans also have certain things they do not cover, called exclusions. For example, they might not pay for experimental treatments, wellness visits just to feel better, or care from someone who is not licensed. You must read these carefully to avoid surprises later.

Additionally, some plans have rules about pre-existing conditions. This means they might not pay for health problems you already had before getting insurance. So, check how your policy explains pre-existing conditions and see if there is a waiting time before you can get help.

Finally, check for annual and lifetime benefit limits. These limits can change how much money you have to pay yourself. For example, if your plan only covers $300 for acupuncture each year, you will need to pay the extra money if your treatments cost more. By understanding all these details, you can plan better and avoid big bills later.

Read More About Ultimate Guide to Choosing the Best Travel Insurance for your Trip — >>>

What to Do If Acupuncture Isn’t Covered by Your Insurance:

Use Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs):

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) give you great ways to pay for acupuncture when insurance doesn’t cover it. Both types of accounts let you use pre-tax money to pay for medical costs. Because of this, you can save money and lower your treatment costs at the same time.

The good news is that acupuncture counts as a medical expense under IRS rules. So, you can use your HSA or FSA money to pay for it and then get the money back. In fact, using these accounts can lower your real acupuncture costs by 20–30%, depending on your tax rate.

To get the most out of these accounts, plan your acupuncture visits carefully. If you know you will need regular treatments, you should put enough money in your HSA or FSA at the start of the year. This way, you can cover all your expected costs and not worry later.

Explore Payment Plans and Financing Options:

Many acupuncture clinics know that high costs can stop people from getting helpful treatments. Because of this, lots of clinics offer flexible payment plans to make acupuncture more affordable for everyone.

Usually, payment plans let you split the total cost over many months. Even better, most of these plans do not charge extra interest. Also, some clinics have package deals if you buy many sessions together. This way, each visit costs less, and you can save more money.

Besides that, companies like CareCredit offer special financing options to help pay for acupuncture. They even give deals with no interest for people who qualify. As a result, more people can get the care they need without paying everything at once.

Community Acupuncture Clinics:

Community acupuncture clinics give another low-cost choice by treating many patients at the same time in a big, shared room. Because they treat more people together, these clinics can charge a lot less money but still give strong, effective care.

Usually, community clinics charge only $15–40 per visit. This is much cheaper than private sessions, which cost around $75–200 each. The shared space feels calm and peaceful. While you are treated in your own chair or bed, you share the room with others who are also getting care.

Community acupuncture helps make regular treatment possible for more people, no matter their insurance or income. Now, many cities have different community clinics, so it’s easier than ever to find this affordable and helpful option close to you.

Maximizing Your Insurance Benefits for Acupuncture:

Get a Referral from Your Primary Care Physician:

Getting a referral from your main doctor makes your case for acupuncture insurance coverage much stronger. In fact, medical papers from your doctor show that you really need the treatment. These papers also create a record that supports your claim for acupuncture insurance coverage later.

First, make an appointment with your primary care doctor to talk about your health problem and your interest in acupuncture. Then, bring research articles or trusted information that explains how acupuncture helps with your condition. This extra proof makes it easier for your doctor to support your request for acupuncture insurance coverage.

Next, your doctor’s referral should clearly include your health problem, what treatments you already tried, and why they believe acupuncture is a good choice. This paper is very important if you need to fight against any insurance denial later and want to keep your acupuncture insurance coverage.

Document Your Medical Necessity:

Also, keep very detailed records of your health problem, all your symptoms, and treatments you tried before. Insurance companies always need strong proof that acupuncture is a real medical treatment and not just general wellness care.

Then, make sure to keep copies of all your medical records, like test results, treatment notes, and doctor letters. These papers show how your condition has changed over time. They also help prove that acupuncture is necessary and that you really need acupuncture insurance coverage.

Finally, track your symptoms and pain levels before, during, and after each acupuncture session. This clear information helps support more treatment approvals. It also shows that acupuncture really works for your special situation and makes your case for acupuncture insurance coverage even stronger.

Conclusion:

Acupuncture keeps proving to be a natural and effective way to relieve pain and improve overall health. However, whether your insurance covers acupuncture depends on your plan type and provider rules. Because of this, always check your benefits carefully and look for other payment options if needed.

We encourage you to contact your insurance company today to find out about your acupuncture insurance coverage. You can also schedule a free consultation with our licensed acupuncturists to discuss your health goals. Plus, don’t forget to download our free guide with tips on how to make the most of your acupuncture insurance coverage.

Take the first step toward a healthier, balanced life by discovering how acupuncture can be an affordable and powerful part of your wellness journey.