Introduction to Medicaid Health Insurance:

Losing your job can already feel very stressful, and worrying about losing your healthcare coverage makes it even worse. However, there is good news because Medicaid health insurance works as an important safety net and gives important health coverage to people who really need it.

Because of this, you can feel more secure even during hard times. In this easy-to-understand guide, you will learn everything you need to know about Medicaid for people without jobs. First, you will learn about who can get it and how to apply. Then, you will learn about the different benefits, the rules that change depending on your state, and expert advice that can help you. By knowing all this, you can get affordable healthcare when life feels tough. No matter if you just lost your job or if it has been a few months, understanding all your Medicaid options can help you keep your health and protect your money during difficult times.

What Is Medicaid Health Insurance?

Medicaid is the biggest public health insurance program in America, and both the federal government and each state pay for it together. While Medicare mainly helps older people, Medicaid gives health coverage to people and families with low incomes all across the country, including many people who do not have jobs.

Today, Medicaid helps more than 80 million people across America by giving them complete healthcare coverage. For people who lose their jobs, Medicaid fills the gap between losing job-based insurance and finding a new plan. This way, no one has to skip going to the doctor or getting medicine because they don’t have enough money. Unlike private insurance plans, Medicaid is very different because usually there are no monthly payments (called premiums), and most people pay very little when they visit the doctor or get medicine. This makes Medicaid very helpful for people who do not have jobs and need to save every dollar to pay for food, rent, and other important things.

Eligibility Criteria of Medicaid Health Insurance for Unemployed Individuals:

Establishing eligibility for Medicaid health insurance can seem complex, but its basic requirements are straightforward. Your eligibility depends mainly on factors like income level, household size and specific life events.

Income Requirements

Income Requirements:

Most states use the Modified Adjusted Gross Income (MAGI) methodology to establish eligibility. As of 2024, federal poverty level guidelines serve as benchmark. A single person earning up to $15,060 typically meets this criterion, whilst families can make as much as $31,200 before qualifying.

Income limits increase for states that expanded Medicaid under the Affordable Care Act; adults in such states may make up to 138% of the federal poverty level and still be eligible.

Special Circumstances:

Being unemployed doesn’t guarantee Medicaid eligibility, but it significantly increases your odds. There are various factors which could enhance this possibility:

- Pregnancy: Pregnancy opens up coverage options and income limits, often qualifying pregnant women for Medicaid even though they wouldn’t typically meet standard eligibility requirements.

- Disability: Disability provides additional ways of qualifying for coverage. If your unemployment results from being disabled, qualifying through specific criteria with higher income thresholds may help increase the odds that coverage is available to you.

- Family Composition: Family composition matters significantly. Households that include children, elderly members, or individuals with disabilities typically qualify for more generous eligibility requirements.

- Assets: Assets rarely disqualify applicants. Most states don’t consider assets such as savings accounts and property when determining Medicaid eligibility for non-elderly adults.

Also Read About How to Choose the Best Travel Insurance Plans for Your Next Trip — >>>

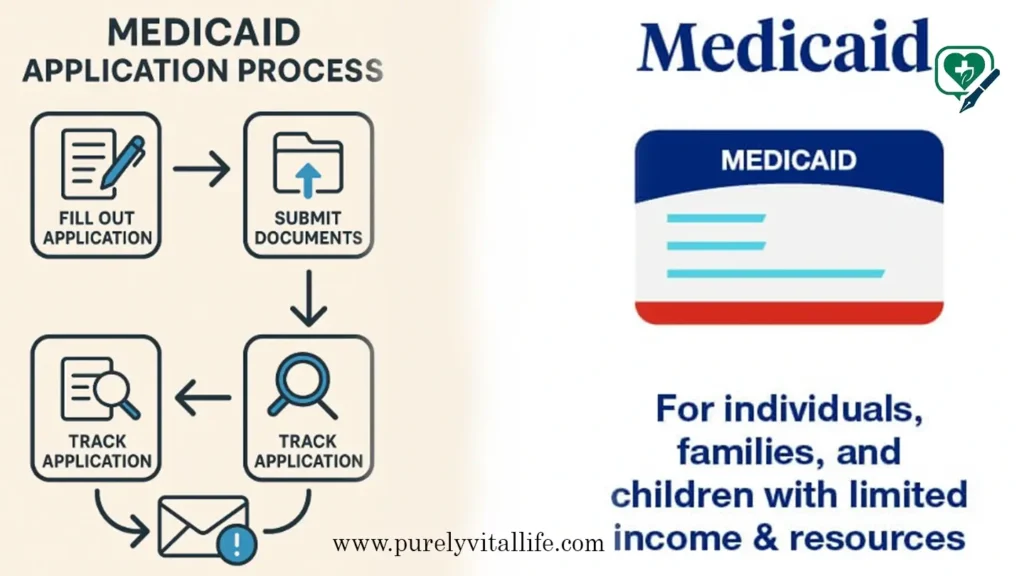

How to Apply for Medicaid Health Insurance:

Submitting an application for Medicaid when unemployed takes some preparation, but is more manageable than many expect. Here is your step-by-step guide: –

Step One – Determine Your Application Method

You have three main application methods available to you for filing:

- Online applications: Online applications through your state Medicaid website or Healthcare.gov offer convenience and instantaneous confirmation of submitted applications.

- Paper Applications: Paper applications may be best for people who prefer physical documentation or have unreliable internet access, as you can download forms directly from your state Medicaid website.

- In-Person Assistance: In-person assistance may also be available through social services offices, community health centres and certified application assisters.

Step 2: Gather Required Documents:

Preparation can prevent delays when starting an application process. Make sure that the following documents are collected beforehand:

- Proof of Identity: Proof of Identity such as driving license, passport or state ID

- Income Verification: Recent pay stubs, unemployment benefits statements or letter verifying zero income

- Citizenship or immigration status documentation

- Household composition information including birth certificates for children

- Social Security cards for all household members

Step 3: Submit Your Application:

Take your time when filling out the application. Rushing can result in errors that stall processing. Be thorough and honest in detailing your circumstances – for example if you currently receive unemployment benefits you should include that as income; or if there is no source of income at present then state this clearly on the form.

Step 4: Submit and Track:

After you submit your application, you’ll receive a confirmation number. It is important that this is kept safe as most states process applications within 45 days; urgent cases may require them being reviewed more rapidly.

Benefits and Coverage Details:

Medicaid provides more than basic medical care; understanding what’s covered helps maximize benefits while keeping you healthy during unemployment.

Essential Health Benefits:

- Doctor visits: Doctor visits are at the core of Medicaid coverage. You can visit primary care doctors and specialists without incurring consultation fees for each visit.

- Hospital Care: Hospital care coverage provides essential protection if you experience serious health issues while unemployed.

- Prescription Medications: This protection can come in the form of emergency room visits, inpatient stays and outpatient procedures – providing peace of mind if serious health concerns arise. Medicaid’s formulary system covers most essential medications while some may need prior authorisation.

- Mental Health Services: Mental health services encompass counselling, therapy and psychiatric care. Unemployment often has adverse effects on one’s mental wellbeing, making these services all the more necessary.

- Preventive Care: Preventive health services encompass screenings, vaccinations and wellness visits designed to protect individuals against more costly health problems in the future. Additional Services

Additional Services:

Many don’t realize Medicaid covers services beyond traditional medical care: for instance, housing assistance.

- Dental Care: Dental care varies by state but typically covers basic services such as cleanings and fillings.

- Vision Care: Vision care may involve exams as well as glasses or contact lenses.

- Transportation: Transportation may also be available in certain areas to enable people without reliable transport accessing necessary care.

Coverage Limitations:

Medicaid’s coverage can be quite expansive; however, certain restrictions do exist. Cosmetic surgeries, experimental therapies or elective services may not fall under its purview; however if deemed medically necessary by your doctor then Medicaid usually provides coverage.

State-Specific Variations and Resources:

Medicaid operates as a partnership between federal and state governments, creating significant variation across the country. Knowing more about your state’s program helps you navigate it more efficiently.

Expansion vs. Non-Expansion States:

Expansion States Under the Affordable Care Act, states were given the ability to expand Medicaid eligibility. So far, 40 states and Washington DC have implemented expansion, while 10 other states have yet to do so.

- Expansion States: Expanding states provide coverage to all adults earning up to 138% of the federal poverty level regardless of children or disabilities.

- Non-Expansion States: Non-expansion states typically have more stringent eligibility criteria, making traditional Medicaid unsuitable for childless adults and leaving unemployed individuals exposed.

Notable State Programs:

- California’s Medi-Cal: California offers Medi-Cal as an extensive coverage option with easy application procedures and provides additional benefits such as transportation services and extended dental care services.

- New York’s Medicaid programme offers comprehensive mental health and substance abuse treatments that are especially valuable to those experiencing unemployment stress.

- Texas as a non-expansion state offers limited health coverage for unemployed adults without children, though pregnant women and families with children may still qualify.

Finding State Resources:

Each state maintains comprehensive Medicaid information on their health department websites, with many offering online eligibility calculators and application tracking systems. Community health centres may also offer assistance and provide insight into state-specific benefits.

Understanding the Affordable Care Act:

The Affordable Care Act fundamentally altered Medicaid access for unemployed individuals. Acknowledging these modifications helps you better comprehend both current opportunities and any possible future developments.

Medicaid Expansion Impact:

Before the Affordable Care Act (ACA), Medicaid health insurance mostly helped families with kids, pregnant women, older adults, and people with disabilities. Back then, healthy adults without children — including many people without jobs — usually could not get Medicaid, no matter how little money they made.

However, when the Affordable Care Act came along, it changed things in a big way. After that, states that chose to expand Medicaid health insurance started covering adults who make up to 138% of the federal poverty level. As a result, millions of unemployed Americans who did not have health insurance before finally got coverage. Because of this important change, many more people now have the chance to get medical care and feel safer about their health.

Coverage Gap Concerns:

In states that did not expand Medicaid, many unemployed people fall into a big coverage gap. They earn too much money to get traditional Medicaid, but at the same time, they do not earn enough money to get help paying for marketplace health insurance plans. Because of this gap, about 2.2 million adults across the whole country are stuck without coverage.

According to Dr. Sarah Mitchell, a healthcare policy expert, Medicaid expansion has been life-changing for unemployed people in the states that did expand. It has given them access to important medical care and protected them from big medical bills. Therefore, if you are unemployed and do not qualify for Medicaid in your state, you should know about other options. Here are some alternatives to Medicaid for people who do not have jobs and need health insurance.

Alternatives to Medicaid for the Unemployed:

Medicaid health insurance may offer the most comprehensive coverage for unemployed individuals; however, other options may exist depending on your specific circumstances.

COBRA Coverage:

COBRA allows former employers to extend their health insurance for up to 18 months after leaving them, at full premium plus 2% administrative fees – often costing unemployed individuals from PS400-800 per month.

This health insurance can provide continuity of care during job changes as it provides ongoing medical needs not covered by Medicaid. Read More

State-Funded Health Programs:

Many states provide state-funded health programmes for low-income residents. These may provide basic medical services, prescription assistance or specialty care.

- California’s Healthy Counties: California offers its Healthy Counties program to counties with limited healthcare resources.

- Texas’ Healthy Community Collaborative provides basic healthcare services in underserved areas.

Charitable Organizations and Free Clinics:

Community health centres and free clinics offer essential healthcare services regardless of one’s insurance status, and the Health Resources and Services Administration has funded over 1,400 community health centres nationwide.

These facilities offer sliding fees based on income and can provide care while your Medicaid application process takes place.

Healthcare Sharing Plans:

Its Healthcare Sharing Plans can be an attractive option for some unemployed individuals looking for cost-saving measures and affordable coverage of medical expenses, particularly since preexisting conditions may not always be covered under such plans.

Common Mistakes to Avoid When Applying:

Learning from others’ mistakes is an invaluable way to save time and speed up approval processes. Here are the most frequently made errors with steps on how to avoid them:

Documentation Errors:

- Incomplete Income Information: One of the main difficulties associated with application processes is incomplete income information. If you’re unemployed, state your current income status clearly. Include unemployment benefits as income but be sure to state when these will end.

- Missing Houshold Information: Lacking household information causes delays. Be sure to include all members, even those not applying for coverage; family size impacts eligibility calculations.

- Outdated Documents: Outdated documents slow processing. Use recent pay stubs, bank statements and other financial documents within 30 days; information older than this may require revised versions.

Application Process Mistakes:

- Rushing through applications leads to errors. Take time to read each question carefully and provide complete responses.

- Failing to report changes can significantly erode coverage – so if your employment or income status changes during the application process, make sure it’s reported immediately!

- Missing deadlines for additional information requests could result in application denial, so be sure to respond quickly when receiving requests from your state Medicaid office. Forgetting to track application status keeps you unaware of any processing delays or changes in timeline.

Conclusions:

Being proactive during the Medicaid health insurance application process is very important if you want to succeed. First, you should always stay up-to-date with all the information about your application. Then, when someone asks you for more information or documents, you should respond quickly. Also, you need to keep track of any changes in your life, like your income or address, so you can tell them right away. If you do these things carefully and act on time, you will have a much better chance of getting your health coverage without any delays or breaks. In the end, staying alert and doing everything on time really helps you avoid problems and makes it easier to get the help you need.

Very good informative content. Keep continue your absolutely work.